An Individual's Investment Horizon Refers to Which of the Following

Compensation of the investment manager for providing either active or passive portfolio management B. An investors preference to minimize exposure to risk.

10 Amazing Budgeting Tips And Tricks To Try Right Now Budgeting Tips Budgeting Money Management

This type of investment raises money by selling its own shares to investors.

/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

. Investing in companies through the stock market offers a chance to share in the profits of those companies. No matter what type of investment an individual makes there are always two factors to consider when evaluating risk and reward. People invest in the stock market because.

Creates a standard by which to establish an appropriate investment time horizon. Read full definition in shares. C decreased since 1990.

Determines most of the portfolios returns and volatility over timed. D organizing the investment management process itself. Helps the investor decide on realistic investment goalsb.

The term investment horizon refers to __________. The proportion of short-term to long-term investments held in an investors portfolio B. A deposit account at a financial institution that allows withdrawals and deposits.

An efficient portfolio is a portfolio that falls on the investors risk preference function which describes the investors trade-off between risk and return. 8 Longevity Risk Longevity Risk is the risk of outliving the savings or investments particularly pertain to retired or nearing retirement individuals. Read full definition risk applies to an investment Investment An item of value you buy to get income or to grow in value.

D none of the above. Stocks riskier and bonds. 9 Foreign Investment Risk.

The average maturity date of investments held in a portfolio D. A monitoring market conditions and relative values B monitoring investor circumstances. The sale of an asset to reverse an invested position.

An account used to buy investments like stocks bonds and mutual funds. When making investment decisions an investors portfolio distribution is influenced by factors such as personal goals level of risk tolerance and investment horizon. The asset allocation decisiona.

A Funding just one or a small number of firms. An investment time horizon is the time period where one expects to hold an investment for a specific goal. The first factor is called the time horizon of the investment which.

A Statement of Investment Policy prepared for distribution to a client that purchases asset allocation services covers all of the following EXCEPT. Investments are generally broken down into two main categories. The maturity date of the longest investment in the portfolio.

A structured framework for investment planning based on the investors return objectives risk tolerance and constraints. Customers investment objectives financial needs and financial goals. Goal factors are individual aspirations to achieve a given level of return or saving for a.

Systematic risk cannot be diversified away. D organizing the investment management process itself. The time value of money states that money available now is worth more than the same amount of money later because of its potential to grow.

An investment horizon refers to the length of time that an investor is willing to hold the portfolio. Horizon Risk is the risk of shortening of investment horizon due to personal events like loss of job marriage or buying a house etc. The premium for permanent life insurance is calculated according to all of the following EXCEPT.

All of the following are exempt from registration under the Paper Act EXCEPT. B shifted from pension funds and corporations to wealthy individuals. The investment period can range anywhere between 6 months to one year for short-term goals while it could.

All of the following are examples of institutional investors EXCEPT. Investors typically allocate some of their investments toward stocks bonds and cash equivalents but there are other asset types to consider as well including real estate commodities and derivatives. Costs associated with liquidation of investment.

B Holding equity in the firms that are funded. An interest-paying deposit account at a financial institution that provides a modest interest rate. An investors capacity for risk exposure based on the ability and willingness to assume risk.

Asset allocation is the process of spreading your investments over various types of assets to guard against changes in the market. Investment horizon refers to the time you need to remain invested to realize your goals. It is generally commensurate with the.

C identifying investor constraints and preferences. Identifies the specific securities to include in a portfolioc. Which of the following is not a characteristic feature of venture capital firms.

Under the provisions of a typical defined benefit pension plan the employer is. The part of investment you have paid for in cash. 1 Passive and Active Strategies.

The variance of an individual investment only captures unsystematic risk. An online account used to pay expenses. The passive strategy involves buying and holding Strategy Involves Buying And Holding The term buy and hold refers to an investors investment strategy in which they hold securities for a long period of time ignoring the ups and downs in market price during a short period of time.

C Having a long-term investment horizon. The planned liquidation date of an investmentC. Read more stocks and not frequently deals in them to avoid.

You may have equity in a home or a business. Investments in the stock market. A lock-in period refers to such a period during the investment cycle in between which the investor cannot transfer or liquidate the investment.

Solved 1 The Two Most Important Factors In Describing An Chegg Com

19 Best Ways To Generate Passive Income In 2019 Passive Income Personal Finance Income

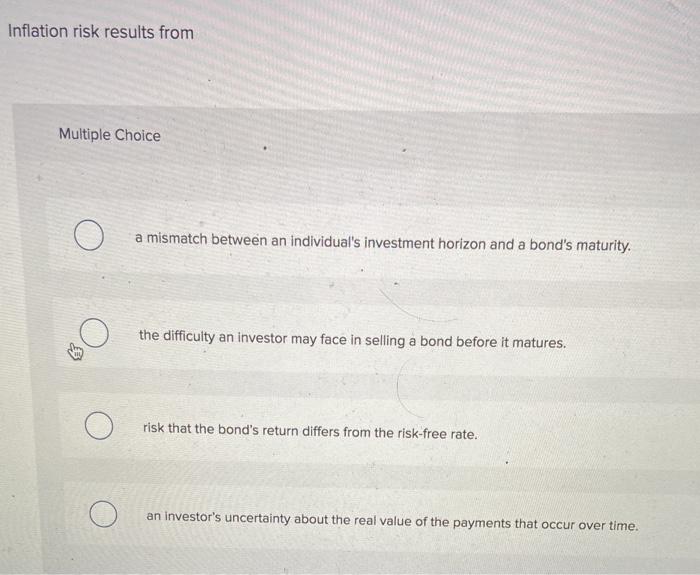

Solved Inflation Risk Results From Multiple Choice A Chegg Com

No comments for "An Individual's Investment Horizon Refers to Which of the Following"

Post a Comment